Default management

- A default can only be declared after approval by OMIClear's Senior Management. Once the default of a Clearing Member (CM) has been declared, OMIClear manages it according to the size and structure of the open positions and pending transactions.

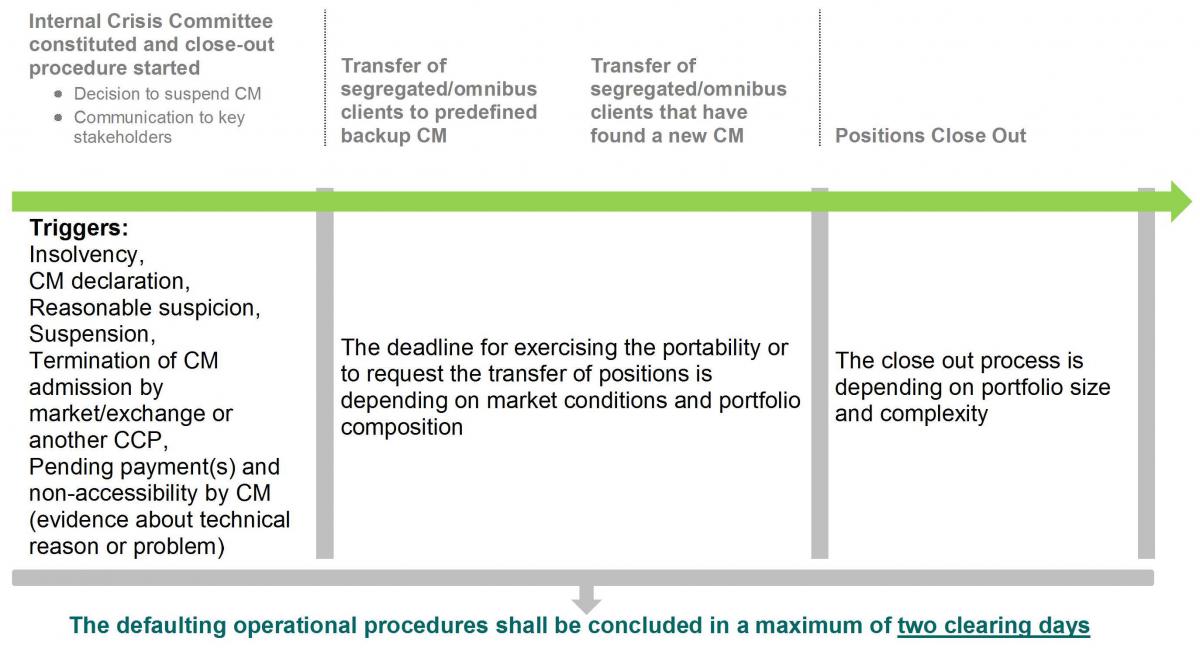

- The Chief Risk Officer calls the Internal Crisis Committee (ICC) which has the authority to make decisions regarding management of the default.

- The ICC is composed of the Executive members of the Board, the Chief Operating Officer, the Chief Risk Officer, the Head of Clearing, the Legal Advisor and the Chief Compliance Officer.

- The close-out is conducted according to the following process:

- All pending transactions and open positions of the Clearing Member and its clients are evaluated.

- Clients with segregated accounts and a backup Clearing Member are transferred to the backup Clearing Member. The remaining clients are provided with a specific timeline to name a new Clearing Member. OMIClear will support the clients’ transfer of positions and transactions to the new Clearing Member.

Any remaining open positions and transactions are netted across proprietary and client positions. Open positions are evaluated and a close-out strategy is set by OMIClear’s Internal Crisis Committee.

This close out strategy takes into account the characteristics of the open positions (such as daily transaction volume, current market situation) to ensure minimum disruption of the market and, at the same time, compliance with the principles of reasonableness and good faith in managing the closing-out of positions. OMIClear can use third parties to manage the close out process.

OMIClear can also decide to keep positions if these do not entail any material risk. The close out procedure can involve the markets OMIClear serves but also a special auction managed by OMIP. Trading Members of OMIP can participate in the close-out procedure on a voluntary basis.

Profits and losses from the close-out process are calculated by OMIClear and if there are losses the Clearing Member’s collateral is used.

- Collateral in segregated accounts is only used to cover losses from the specific segregated accounts. Any remaining surplus is distributed to the respected segregated clients.

- For general omnibus clients any remaining surplus shall be distributed on a pro-rata basis and limited to the value of the responsibilities attached to the clearing accounts in question. If these guarantees are not used, the remaining value shall be returned to the Clearing Member.

- The default waterfall shows the process which is triggered once a participant defaults and OMIClear incurs losses. It comprises the financial resources described under OMIClear's Default Waterfall. The sequence of their usage is stipulated in the figure below.

- Only if the losses from the default of a Clearing Member exceed its individual margins, its individual Clearing Fund contribution and OMIClear's dedicated own resources, Clearing Fund contributions of other non-defaulting members will be used.

- Individual margins of non-defaulting Clearing Members are never used to cover any losses of defaulting Clearing Members.

For further information, please download OMIClear Rulebook and OMIClear Instructions A09/2014 – Defaults, B12/2014 – Default Waterfall and B18/2014 – Procedures in Case of Default, by pressing here.