Risk Model Tests

OMIClear’s testing programs are a core part of OMIClear’s risk management framework to ensure that it can successfully fulfil its role of central counterparty (CCP) under a wide range of plausible scenarios and that its margin system is producing the expected results. Moreover, such tests are a fundamental tool for monitoring closely OMIClear’s risk exposure and react in a timely manner if necessary.

OMIClear carries out daily stress tests for a set of extreme but plausible market scenarios, which include the potential reduction in market liquidity, increase of price volatility, break up in correlations and increase of concentration risk. Such conditions are defined based on extreme events obtained from the complete historical data which are carefully combined in hypothetical scenarios.

The stress tests calculation is performed in OMIClear’s clearing system - MiClear - on a daily basis after the end of day procedures have been completed. Such tests include:

- Verification if the margins required and the default fund contributions cover the highest of the following values under extreme but plausible market scenarios:

1. The losses arising from the default of the clearing member to which OMIClear has the largest exposure;

2. The losses arising from the default of the second and third clearing members to which OMIClear has the largest exposure. - Verification if the combination of margins, default fund contributions and other financial resources at OMIClear’s disposal are sufficient to cover the default of the two clearing members to which OMIClear has the largest exposure under extreme but plausible market scenarios.

Whenever the tests results show that the conditions laid above would not be met an update of the clearing fund value is triggered. Additionally, in case a test result does not fall under an expected range of values, it may also trigger an extraordinary revision of the margin parameters, taking special care with pro cyclicality effects. A call for an extraordinary margin may also be the outcome of an unexpected test result.

Besides the stress tests, OMIClear also conducts back tests on a daily basis in MiClear system. The aim of backtesting is to verify and validate if a model is achieving its purpose. As such, the goal of OMIClear’s backtesting program is to check that its margin model is calculating margins that historically would have been sufficient to cover with a 99% confidence interval, the worst price development for closing out, in the time horizon underlying the initial margin calculation, all positions of a defaulting member.

Specifically, for each day, and for each clearing account, OMIClear compares the initial margin available on that day with the gains/losses that would arise if the underlying portfolio would be closed out at the most unfavourable settlement price verified for the close out period.

In case the computed losses are greater than the initial margin required a hit is registered. If the number of hits in the relevant period is higher than the statistically expected OMIClear shall trigger a revision of its initial margin parameters.

To keep track of the resilience and robustness of the results produced by the new margin model, OMIClear prepared its systems to be able to perform “what-if” tests with total flexibility regarding market conditions.

OMIClear performs sensitivity testing covering a wide range of parameters, including data historical samples, confidence intervals, close out period, large positions and intercommodity credits. The test results are analysed by OMCIear and the Risk Committee to check if there is a need to adapt or refine OMICIear’s margin system.

It is worth mention that if OMICIear verifies that a small change in a margin parameter produces a significant impact on the margin requirements, OMIClear may trigger an extraordinary revision of the margin parameters.

The reverse tests aim to check in which conditions OMIClear would no longer have the sufficient resources to withstand a certain default scenario.

The Clearing Fund value is established based on the stress test results which define the potential costs that OMIClear would incur in case of default of the most exposed members in extreme but plausible market conditions. In other words, one would expect that an aggravation of the extreme but plausible market conditions framework would leave the CCP with insufficient funds to withstand the default of such members.

The reverse tests adopted by OMIClear are based on a trial and error process, through which OMIClear simulates changes (aggravation) to the parameters underlying the extreme but plausible market conditions and checks the available funds to withstand the default of the two most exposed members. Reverse tests are carried out at least on a quarterly basis.

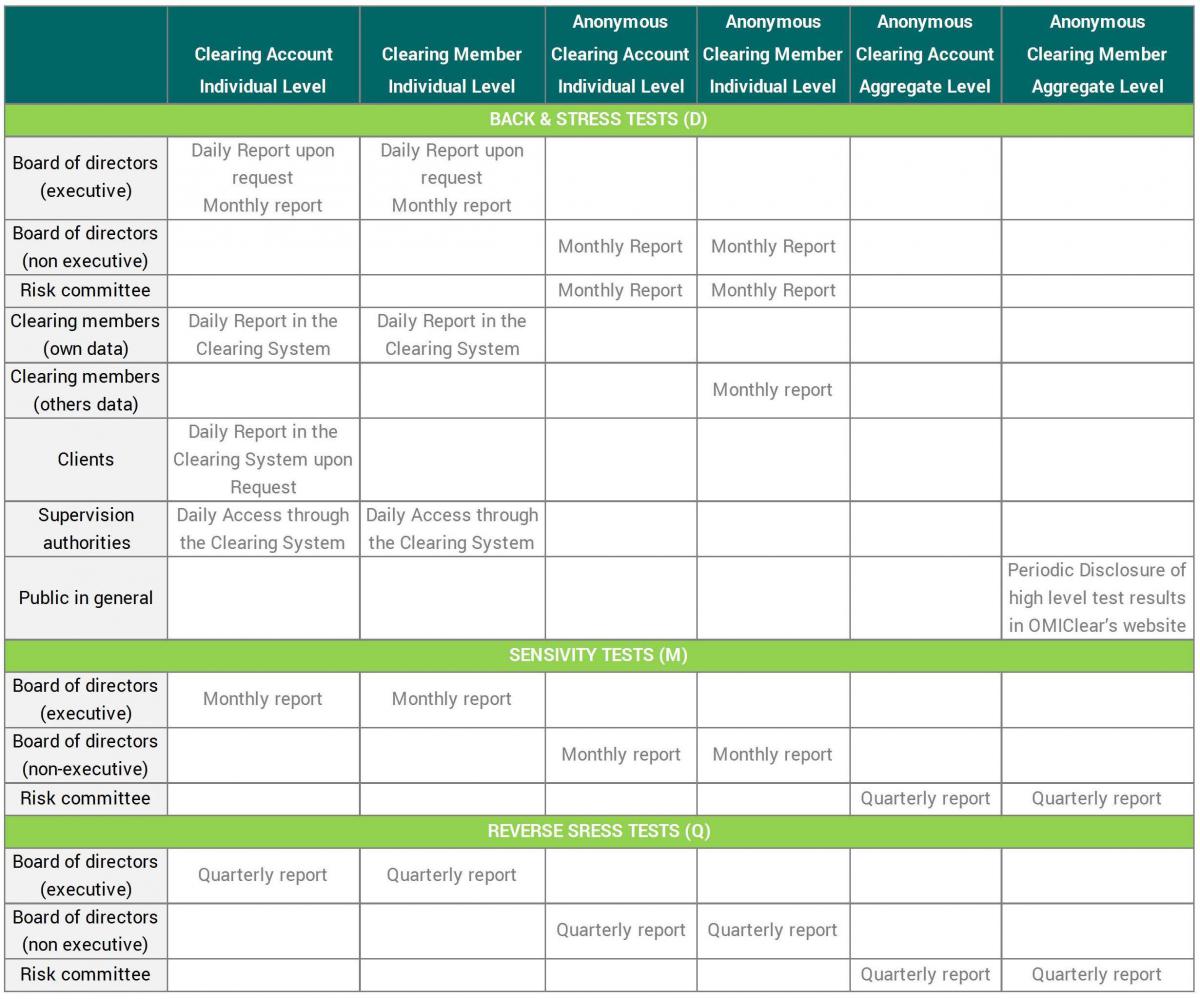

The market risk tests are carried out by the clearing department. Its disclosure policy has the following main targets:

- The board of directors;

- The risk committee;

- The clearing members;

- The clearing members’ clients;

- The supervision authorities;

- The public in general.

Concerning the information to be disclosed, two classes of tests are identifiable:

- External tests, namely stress and back tests, which results are disclosed;

- Internal tests, namely sensitivity and reverse stress tests which will have a limited dissemination.

The table below presents the combination of targets with the disclosed information, frequency and dissemination channels.