Natural Gas Derivatives

PVB-ES NG Physical Futures (‘FGE’ and ‘GES’ contracts)

- On November 24th 2017 OMIClear, in coordination with OMIP – Pólo Português, S.G.M.R., S.A., launched the clearing and settlement service for Natural Gas Derivatives Contracts (MIFID financial instruments). With this service extension OMIClear intended to serve the existing demand for central clearing of natural gas futures contracts with physical settlement at the Spanish virtual balancing point (PVB-ES). These contracts are called ‘PVB-ES NG Physical Futures’ and its system code starts with ‘FGE’.

- Following an interconnection agreement with a new market - Mibgas Derivatives S.A. -, OMIClear launched on April 24th 2018 the clearing and settlement service on Natural Gas Derivatives Contracts to comprise the natural gas futures contracts traded in this organized market. A few months later OMIClear also signed an interconnection agreement with Mibgas S.A. (an organized market designated by Spain’s Law 8/2015 of May 21st of Hydrocarbons Industry) to clear and settle the month ahead and balance of the month natural gas contracts traded in this market, starting on March 1st 2019. These contracts are called ‘PVB-ES NG Physical Futures (Non-Financial Instruments)’ and its system code starts with ‘GES’.

- The so called PVB-ES NG Physical Futures are listed in the 3 markets (OMIP market – ‘FGE’ contracts and Mibgas Derivatives / Mibgas markets – ‘GES’ contracts) and share exactly the same underlying asset, contract specifications, margin model and settlement type in the delivery period (i.e. daily positions’ notification to Enagás GTS by OMIClear). The only difference has to do with the financial classification of the product under MIFID II, which is related to the market type: OMIP as a ‘regulated market’ according to this financial regulation, contrary to Mibgas Derivatives and Mibgas.

PVB-ES NG Financial Futures (‘FGF’ contracts)

- Following the development of the liquidity in the Spanish natural gas market, on February 1st 2022, OMIClear extended its CCP service to the natural gas futures contracts with financial settlement at the Spanish virtual balancing point (PVB-ES) listed in the regulated market OMIP – Pólo Português, S.G.M.R.

- By extending the current physical settled natural gas products at the Spanish Virtual trading Point (PVB-ES) to cash settled natural gas products at the same Virtual trading Point, OMIP and OMIClear aim to provide access to the natural gas market to some market participants that do not need the physical notification at the PVB-ES, also facilitating trading on cross-products (e.g. to hedge power and natural gas price differentials).

NG Futures linked to TTF (‘FST’ and ‘GIT’ contracts)

- On September 12th 2023, resulting from the market needs of having more hedging tools, in particular, in the spread of PVB and one of the most liquid hubs in the European gas market –TTF, OMIClear has extended the clearing and settlement services to the following two products:

- PVBES-TTF Spread Futures (‘FST’ contracts) – financial natural gas contract listed OMIP – Pólo Português, S.G.M.R. market which is financially settled during the delivery period against the spread between PVB-ES Index and ICIS TTF Day-Ahead / Weekend Index)

- PVB-ES NG Physical Futures indexed to TTF (‘GIT’ contracts) – natural gas contract with physical delivery in the Spanish PVB virtual trading point (as the PVB-ES NG Physical Futures) that is listed in Mibgas Derivatives S.A. market. The cash settlement during the delivery period is based on ICIS TTF Day-Ahead / Weekend Index.

PVB-ES NG Physical Futures indexed to MIBGAS Day-Ahead (‘GIM’ contracts)

- In response to the growing interest by market participants to be able to physically hedge their future needs at PVB, but keeping exposure to MIBGAS spot price signals, on February 20th 2024 OMIClear extended its clearing services to a new futures contract with physical delivery in PVB and referenced to ‘MIBGAS PVB Last Price Index (LPI) Day-Ahead’, listed in Mibgas Derivatives S.A. market.

TVB-ES NG Physical Futures (‘TVB’ contracts)

- Following the development of the natural gas market in Spain, on October 24th, 2023 OMIClear, in coordination with MIBGAS Derivatives market, has extended its clearing services to a new physical product with delivery on the Spanish LNG virtual trading point (TVB-ES) called ‘TVB-ES NG Physical Futures’ (system code: ‘TVB’) with the following characteristics:

- The cash settlement during the delivery period is based on the last settlement price of the futures contract (like the PVB-ES NG Physical Futures);

- The physical settlement is carried out by OMIClear through daily notification of the physical net positions to the Spanish Technical System Operator (Enagás GTS), corresponding to transfers of ownership related to the sale or purchase of liquified natural gas at the Spanish LNG virtual trading point (TVB-ES);

- Futures contracts classified as non-MIFID financial instruments (as the other contracts listed in MIBGAS and MIBGAS Derivatives that are cleared by OMIClear).

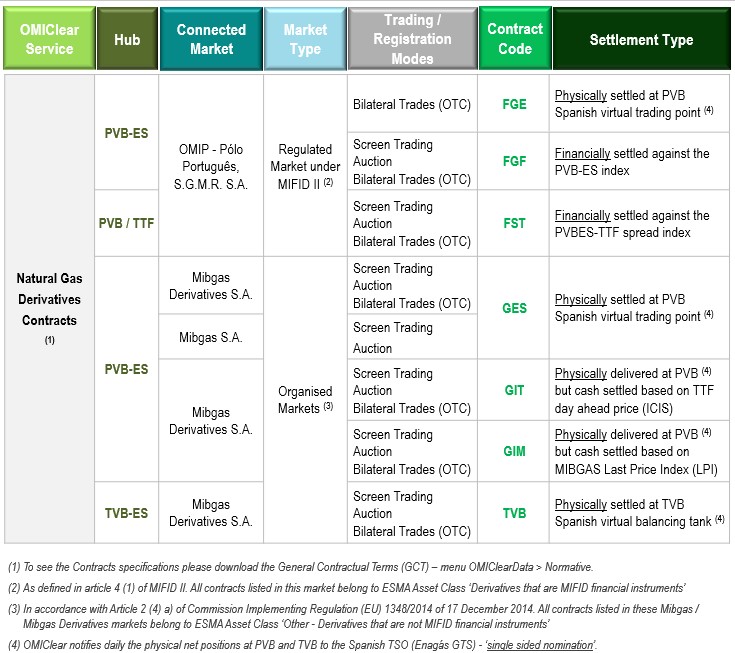

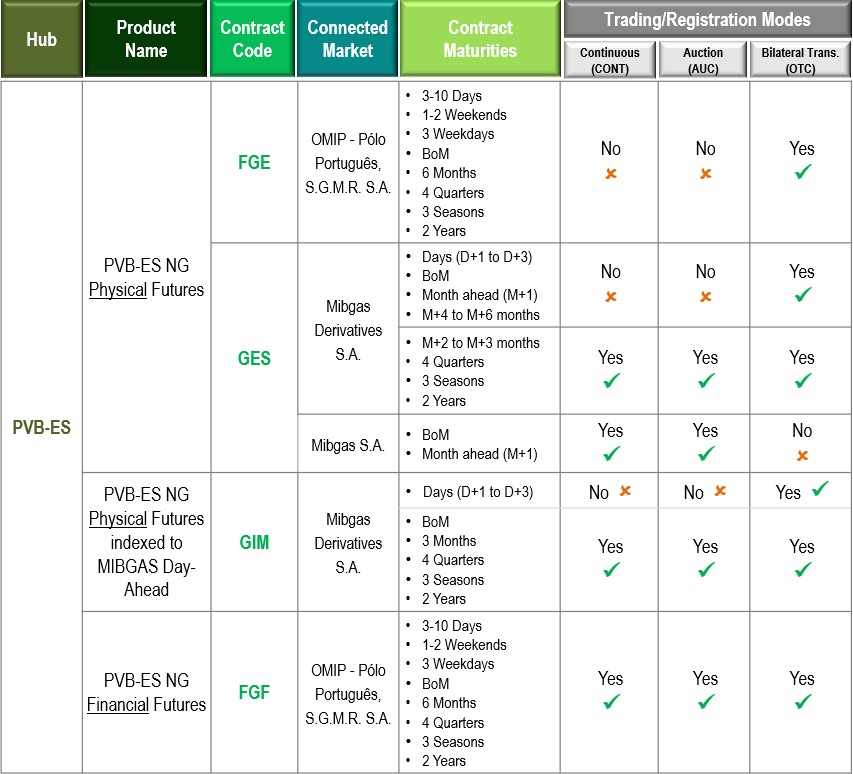

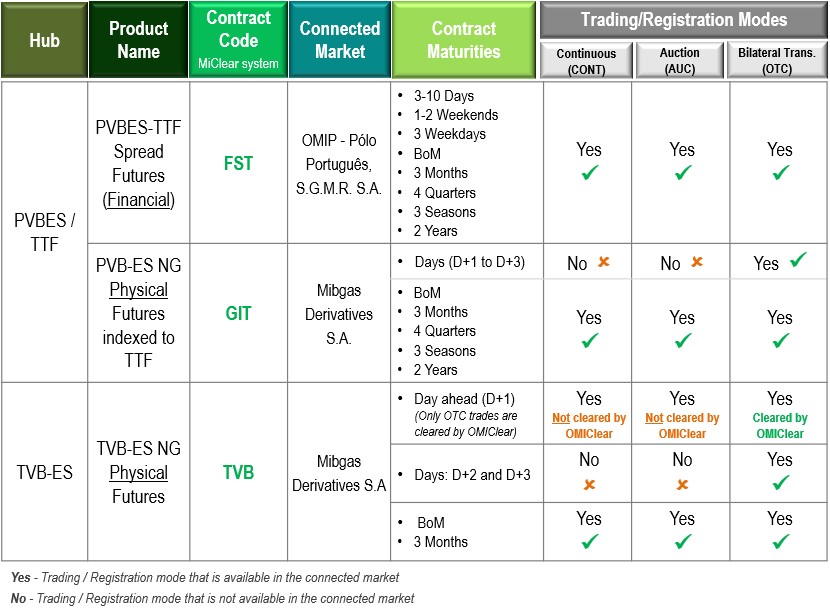

In this context the Service on Natural Gas Derivatives Contracts provided by OMIClear currently comprises the following contracts and markets:

To see the detailed specifications of these contracts please download the General Contractual Terms (Gas).

The classes of financial instruments covered by OMIClear's CCP authorisation are published in ESMA website: www.esma.europa.eu/sites/default/files/library/ccps_authorised_under_emir.pdf

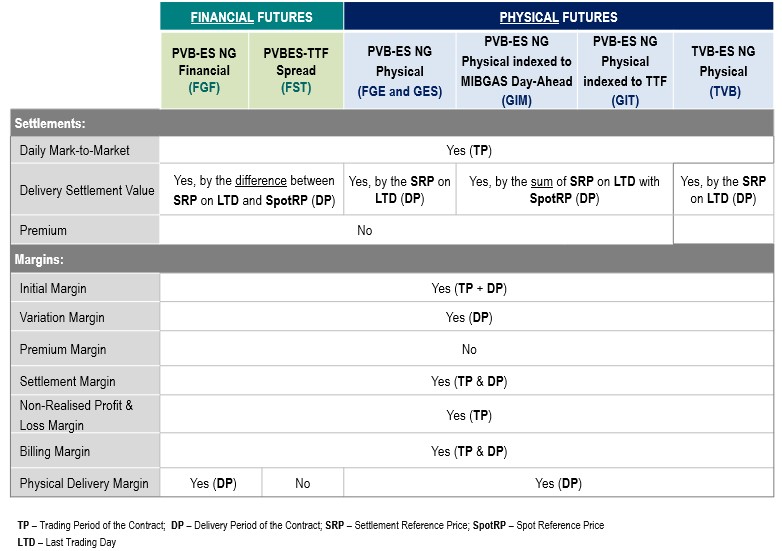

The type of cash settlements and margins applicable to these derivatives contracts across their lifecycle (during Registration Period and Delivery Period) are summarized in the following table:

For further details on the margin model, please see Risk model > Margin model.