Margining model

- OMIClear has in place a margin system that automatically calculates margins designed to limit the CCP’s credit exposure from its Clearing Members and based on a methodology that is fully documented in OMIClear's Instruction B10/2014 - Calculation of Margins and Settlement Values (available for download here).

- The resources coming from margin calls make part of the waterfall mechanism in place in OMIClear, consisting on the first tier to be activated in case of default as referred in Risk Management > Lines of Defence.

- OMIClear’s margining comprises the entire process of measuring and calculating a Clearing Member’s risk exposure. The provision of collateral by the Clearing Members to fulfill OMIClear’s margin calls has the purpose of ensuring that all financial commitments arising from the open positions of a Clearing Member can be offset within a very short period of time.

- A Clearing Member’s total margin requirement is the amount that is equivalent to such member’s risk exposure before OMIClear. Since members must provide collateral for their margin requirements, the counterparty risk exposure decreases by the value of the collateral provided to the CCP.

The following types of margins are calculated by OMIClear:

- Initial Margin (IM) - covers the risk of having to face the estimated worst price development for closing out, in a short time period, all positions of a member in default. IM is always covered through collateral;

- Variation Margin (VM) - similar to the mark-to- market (that applies to the futures contracts during its trading period) but instead of being daily cash settled, negative VM amounts are covered through member’s collateral. It covers the market risk related to gains and losses on open positions resulting from variations of the Clearing Prices during delivery period (in case of Futures contracts) or during trading and delivery periods (in case of Swaps and Forwards contracts);

- Nonrealized Profits and Losses Margin (NRPLM) - covers the intraday gains and losses in tradable contracts (an intraday mark-to- market concept which must be fulfilled with collateral). Only negative NRPLM values (member’s estimated mark-to- market losses) are to be fulfilled with collateral. At the end of the day this margin no longer applies since it becomes replaced by the effective Mark-to- Market (MtM) amount to be cash settled within the daily financial settlement scope (Target2 system);

- Settlement Margin (SM) - covers the credit risk regarding amounts (delivery settlement value and mark-to- market) already due by the Clearing Member but which have neither been “invoiced” in the clearing system nor cash settled through the daily financial settlement (Target2 system). Only negative SM (member’s debit amounts) are fulfilled with collateral;

- Billing Margin (BM) - covers the credit risk regarding amounts (mart-to- market, delivery settlement values and fees) already invoiced in the clearing system but not yet cash settled through the daily financial settlement (Target2 system);

- Extraordinary Margin (EM) - to protect market security, OMIClear may require an Extraordinary Margin taking into consideration, in particular, the market circumstances regarding price volatility, the sudden increase in a clearing member’s exposure or the concentration level of the clearing member’s positions in the market;

- Premium Margin (PM) - covers the risk of the member’s gains and losses regarding positions in option contracts;

- Physical Delivery Margin (PDM) – specific margin to cover the risk related to positions in the following products: PVB-ES NG Physical and Financial Futures, TVB-ES NG Physical Futures, PVB-ES NG Physical Futures indexed to TTF and PVB-ES NG Physical Futures indexed to MIBGAS Day-Ahead that are under delivery. In particular, the PDM refers to the estimated losses that result from the price aggravation arising from the “unbalanced tariff” (or “tarifa de desbalance”) to be applied by the Spanish TSO following a default event.

- Regarding the Initial Margin, which purpose is to cover a member’s potential exposure, OMIClear’s methodology is based on a portfolio margin approach, integrating into the same system to assess a portfolio’s risk:

a) Different commodities: power and natural gas;

b) Different underlying assets: Power: Spain, Portugal, France and Germany // Natural Gas: Spanish virtual trading points "PVB-ES" and "TVB-ES", and spread between PVB-ES and TTF;

c) Different product types: futures, forwards, swaps and options on futures contracts;

d) Different load shapes (in case of power derivatives contracts): baseload, peak load, solar;

e) Different contract maturities: Power: days, weekends, weeks, months, quarters, years and PPA (for 5 and 10 years) // Natural Gas: days, weekends, weekdays, balance of the month, months, quarters, gas seasons and years.

- Positions are examined over a range of price and volatility changes to determine potential gains and losses.

- Several risk parameters are used in the calculation of the Initial Margin which fulfills the requisites established by EMIR and its RTS, in particular:

- Estimated price variation (range) - The range is set in order to capture the possible change in the underlying prices of the derivatives contracts cleared by OMIClear over the established liquidation period, with at least 99% or 99,5% probability (depending on the product), in particular:

Contracts classified as ‘Exchange Traded Derivatives (ETD)’ according to MIFID:

- Liquidation period (non-large positions): 2 days

- Confidence Interval: 99%

Contracts not classified as ‘ETD’ according to MIFID:

- Liquidation period (non-large positions): 5 days

- Confidence Interval: 99,5%

The values are calculated using two samples:

- The complete relevant historical price data

- The price data of the previous twelve months

The liquidation period (for non-large positions) has been decided by OMIClear based on 3 important assumptions:

i) The time elapsing between the last collection of margins and the moment in which the default is detected

ii) The expected time consumed with the operational procedures once the default is detected

iii) The dimension and concentration of the positions to close out

Regarding the options on future contracts, OMIClear computes the implied volatility variation based on the same methodology as the one to compute the price range.

- A 25% weight is assigned to the average of the stressed observations calculated with the complete relevant historical price data and a 75% weight is assigned to the higher of percentile 1% and 99% (or percentile 0,5% and 99,5% in case of ‘non-ETD contracts’) of the drawdown series of the last 12 months. The inclusion of stressed observations in the range computation aims at minimizing the procyclicality effects;

3. Large Positions Aggravation Factor – OMIClear charges an extra margin for concentrated positions or positions in contracts with reduced liquidity.

The liquidation period for large positions is set as follows:

- ETD contracts: 3 days

- Non-ETD contracts: 5 days

The aggravation factor applied to large positions consists of:

- ETD contracts: the percentage variation between the range parameter calculated for 3-day period and the one calculated for 2-day period

- Non-ETD contracts: not applicable as the liquidation period for large positions and non-large positions coincide (5 days)

4. Credits between different products – OMIClear assigns a margin credit for offsetting positions between correlated contracts. At least 250 observations must exist in order to compute a correlation. Only pairs of products presenting statistically significant correlations are eligible for margin credits.

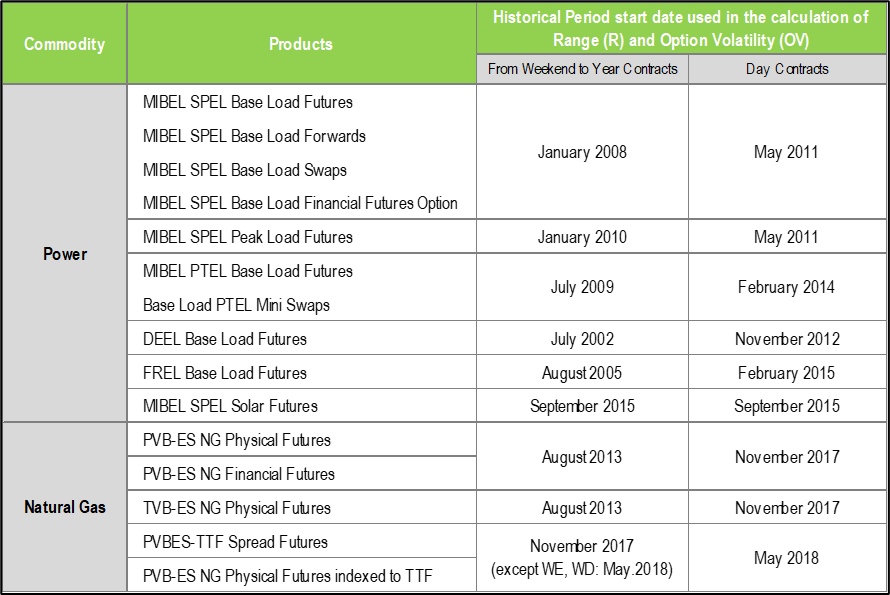

- The Time Horizon used for the calculation of the historical volatility of the cleared products (underlying the calculation of the range, in the case of Futures, Swap and Forwards and the calculation of the implied volatility, in the case of Options) seeks to capture a full variety of market conditions, including periods of stress:

- The risk parameters are updated on a monthly basis (or ad hoc when the market conditions warrant) and available for download here.

- The Initial Margin methodology obtained a positive validation from an external independent entity and a positive opinion by OMIClear’s Risk Committee.

- In accordance article 41 of EMIR and article 28 of RTS 153/2013, OMIClear has in place tools to prevent and control possible procyclical effects on the Initial Margin

- In order to avoid procyclical effects the margin requirements are modified prudently, particularly when the results of the monthly revision shows that a reduction of the range parameters should apply.

- In particular, if the monthly revision (M) results in a proposal to reduce the range parameters, its implementation will be postponed to the following month (M+1) and will only be applied if the results of the second monthly revision confirm that the reduction obtained in month M is not temporary. On the other hand, if the review leads to an increase of the range parameters, the new parameters will be applied in the following clearing day.

- Where the metrics indicate procyclical effects arising from the Initial Margin calls, OMIClear will review its application of the anti-procyclicality margin measures and will make the appropriate adjustments to its Policy to ensure that such effects are adequately addressed.

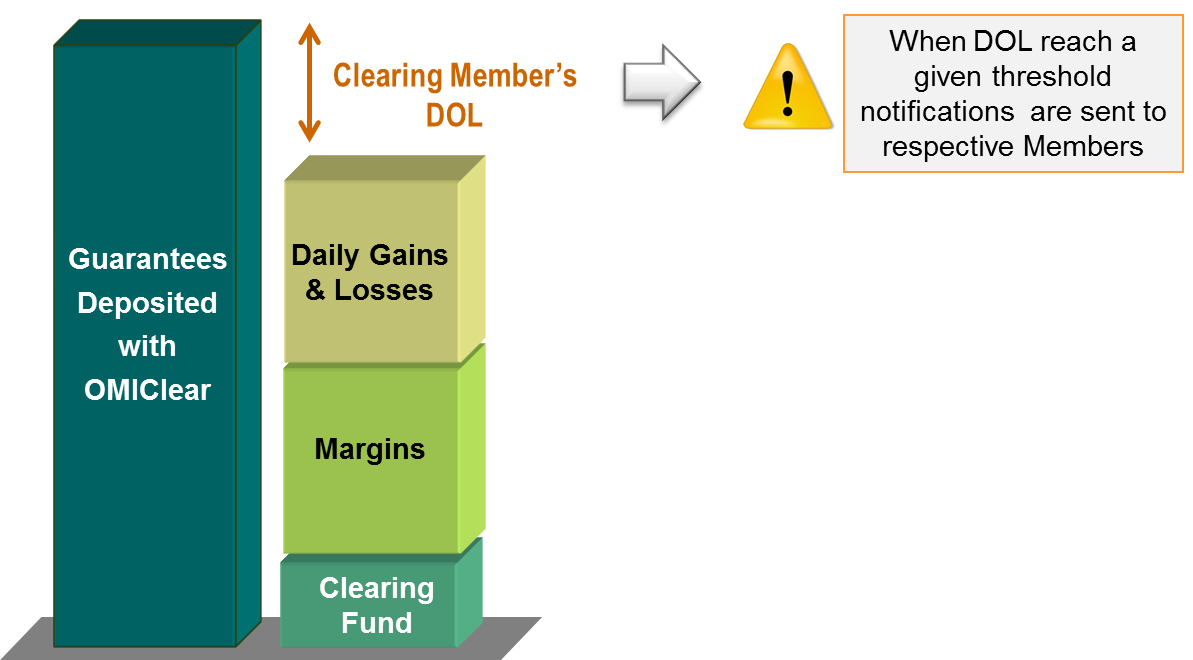

- Clearing Members’ risk exposure is monitored on a close to real time basis. The Daily Operational Limit (DOL) consists of the balance between member’s deposited collateral and its responsibilities before the CCP (margins, clearing fund, daily gains and losses).

- The DOL indicator is automatically updated by the clearing system with new trades and market prices fluctuation throughout the clearing session and at the end-of-day. At any time of the session both Clearing Members and the clearing staff of OMIClear can verify the DOL and see if any actions shall be triggered (to decrease the risk exposure by reducing the open positions or to increase the collateral deposited with OMIClear).

- Whenever the DOL indicator reaches a minimum threshold the clearing staff of OMIClear is informed through automatic system alerts and the following actions are triggered:

a) The market operator is informed in order to inhibit the respective trading members to make trades that might cause an increase of clearing member’s risk exposure;

b) Clearing Members are duly informed of the DOL situation and the need to increase collateral with OMIClear. - The DOL is calculated for Clearing Members and also for clients of Clearing Members that have opted for segregated clearing accounts. For further details, see Risk Management > Accounts Structure.