EMIR reporting

According to article 9 of Regulation (EU) No 648/2012 of the European Parliament and of the Council 2012, of 4 July 2014 (EMIR): ‘Counterparties and CCPs shall ensure that the details of any derivative contract they have concluded and of any modification or termination of the contract are reported to a trade repository’.

Under this scope OMIClear:

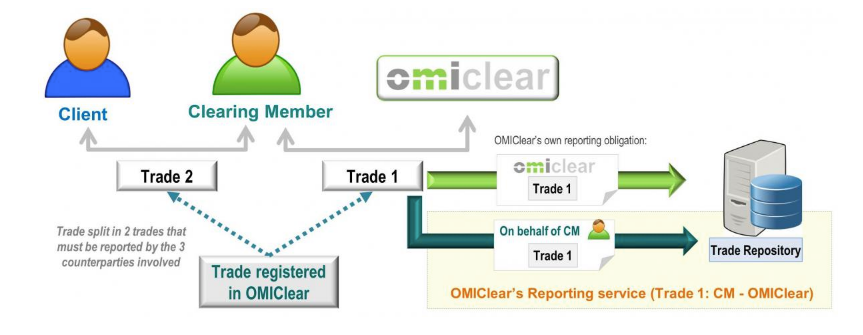

- Satisfies its own EMIR obligations by reporting to the Trade Repository DTCC Derivatives Repository Limited (DTCC onwards) the details of any eligible derivative transaction cleared at the CCP, until the clearing day following its conclusion. In adherence with ESMA guidance, OMIClear also reports end-of-day net positions in order to accurately reflect the underlying valuation of each position held by the CCP.

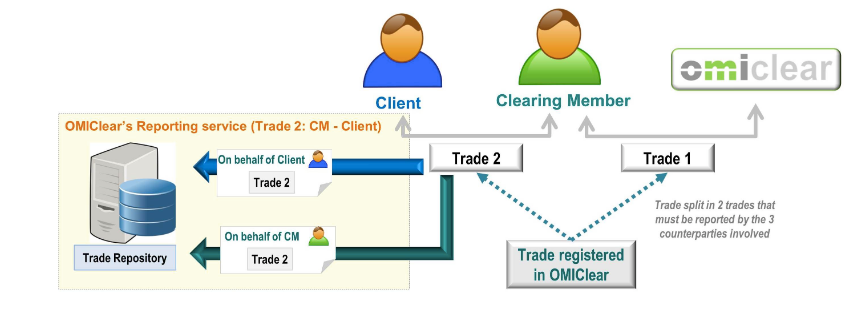

- Provides an EMIR reporting service to Clearing Members and clients of Clearing Members through a ‘Delegated Reporting Agreement’. Clients of this reporting service can safely delegate on OMIClear the fulfillment of their reporting obligations that arise from clearing derivative contracts at the OMIClear CCP. The service comprises the report to DTCC of transactions and end-of-day positions until the following clearing day, as well as the report of valuation and collateral data on behalf of clients with FC or NFC+ status. Included in this delegation agreement is an SFTP service which allows clients to view or automatically download the report files submitted on their behalf by OMIClear.

OMIClear’s EMIR Delegated Reporting service comprises the following solutions:

- Reporting to DTCC on behalf of Clearing Members the details of transactions on which the counterparties consist of Clearing Members and OMIClear (eg: Trade 1 of the figure below):

- Reporting to the DTCC on behalf of Clearing Members and on behalf of their clients regarding the details of transactions on which the counterparties consist of the Clearing Members and their clients (eg: Trade 2 of the figure below):

Only the Derivatives Contracts that are MIFID financial instruments are subject to EMIR Reporting.

The fees applicable to the EMIR reporting are disclosed in OMIClear's Price List.

For further details please see OMIClear’s EMIR Reporting Operational Guide and Guide to EMIR REFIT Reporting Changes.