Information systems

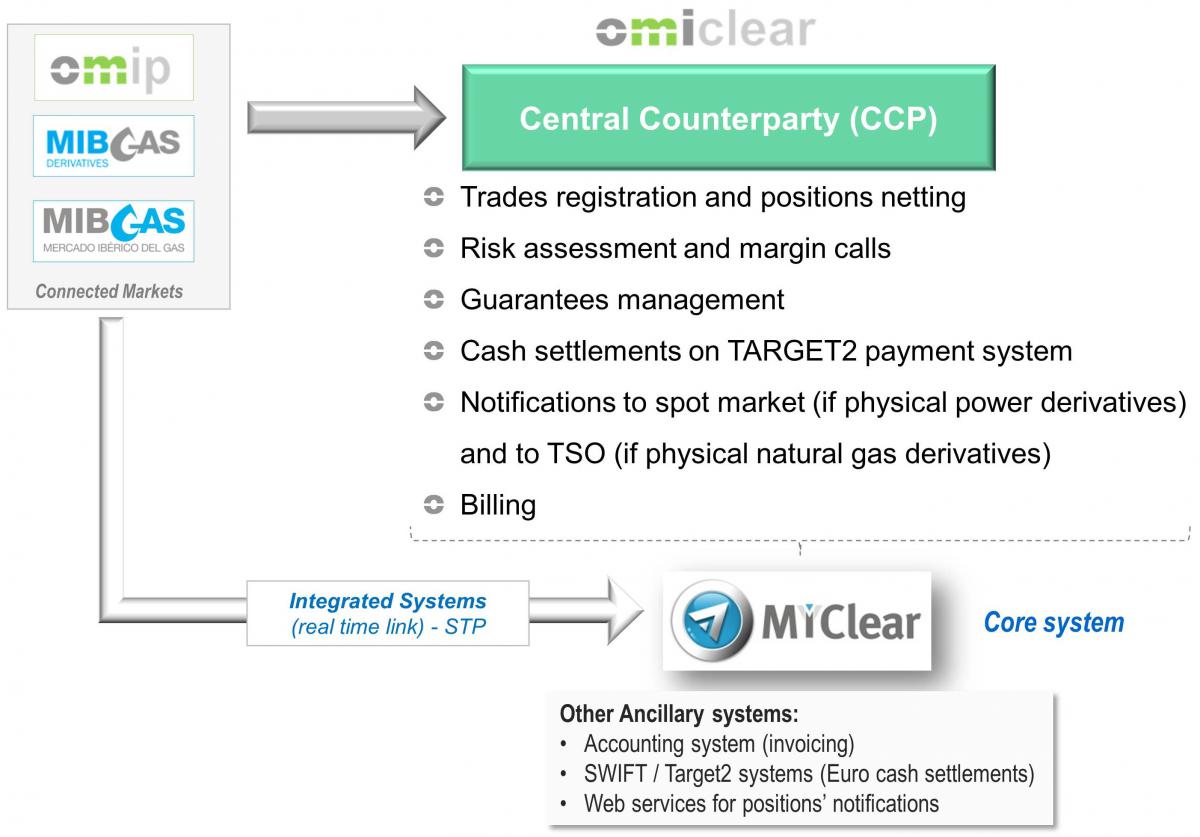

OMIClear business model is built over the following that is supported by reliable and robust systems. The main system for its core activities as CCP is called ‘MiClear’.

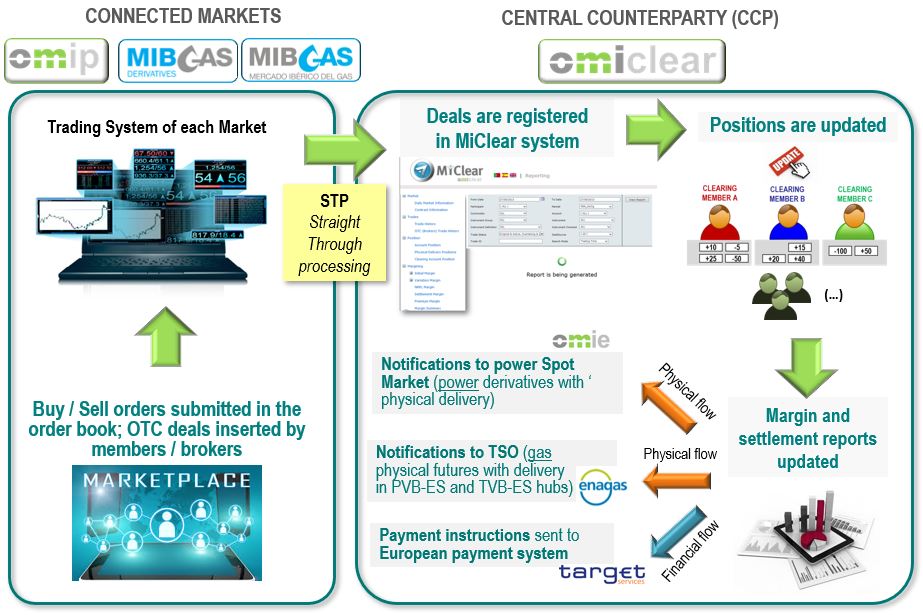

In terms of market cycle, once the orders are matched (in case of continuous trading or auctions) or once the bilateral trades (OTC deals) are submitted in the connected Market, the resulting deals are registered in OMIClear for clearing and settlement based on a Straight Through Processing (STP) solution.

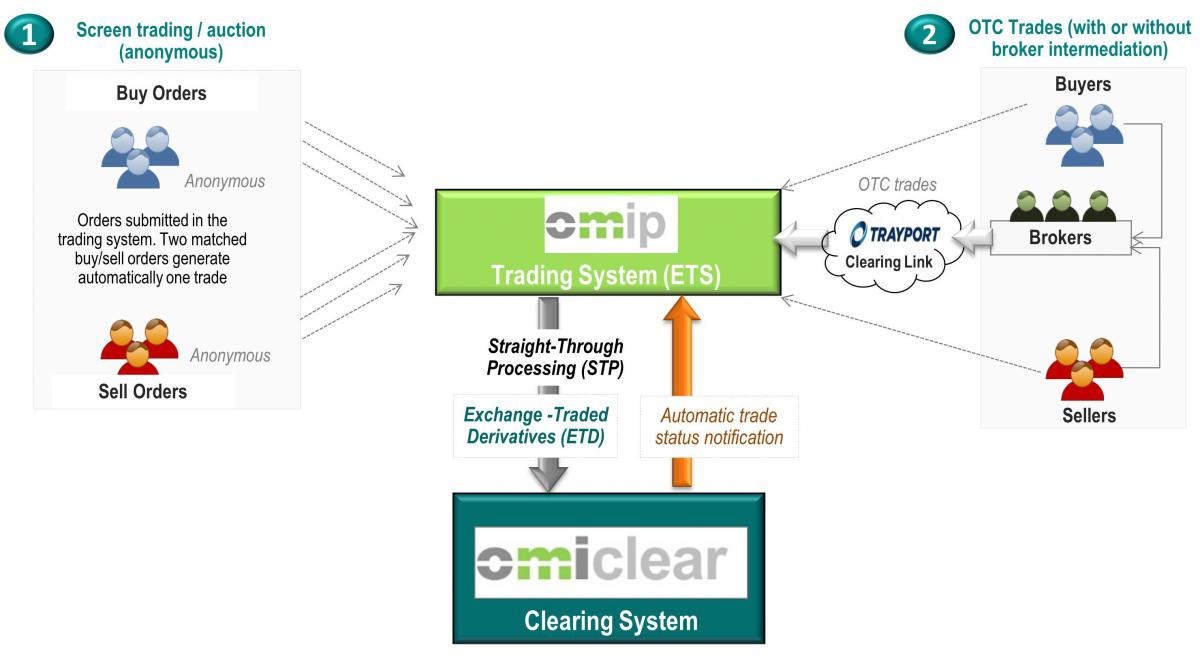

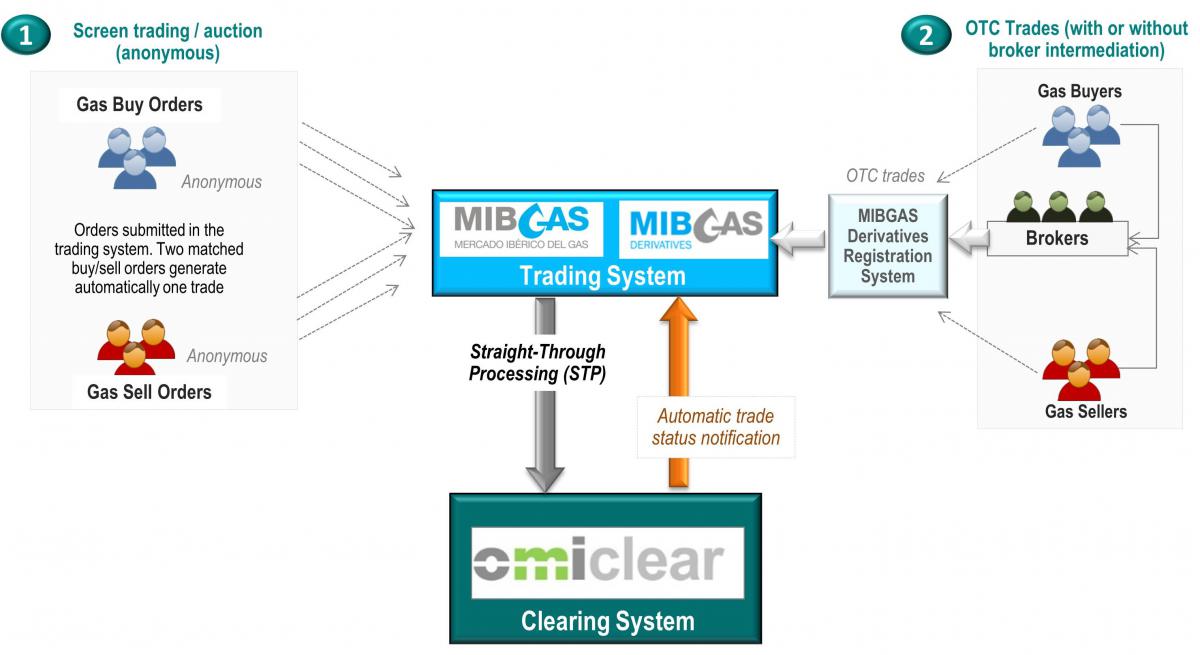

- Every transaction resulting from a matching process of orders (screen trading or auction) in the Trading System of a Market to which OMIClear is connected (OMIP, MIBGAS or MIBGAS Derivatives) are registered automatically in the Clearing Platform - MiClear - through an STP (Straight-Through Processing) process preserving the anonymity feature. Once the Transaction is registered the MiClear system proceeds automatically and on a near real-time basis with the update of positions, margins and provisional gains and losses of the counterparties involved.

- Every Bilateral Transaction (OTC trades), whether intermediated by a broker, or purely bilateral (without intermediation), with the purpose of being registered, cleared and settled by OMIClear shall be submitted through the Trading System of the respective Market (in this case, OMIP or MIBGAS Derivatives) in order to be immediately sent to MiClear system through the same STP process.

OMIP Derivatives Market (MIFID II Regulated Market)

MIBGAS S.A. and MIBGAS Derivatives S.A. Organised Markets

The MiClear system was designed to provide market participants with all necessary clearing and settlement information in an efficient way, on a close-to-real-time basis, allowing for two main access modes:

- Web-based frontend, that includes all functionalities available to participants;

- XML API for systems integration.

The MIClear's API is a read-only API, available to all participants, for extracting and integrating clearing data (public and confidential), related to trading activity performed over OMIClear eligible contracts. This API follows the XML Web Services open standard which is platform agnostic and widely deployed.

The information provided by the MiClear system includes current and historical data including:

- Trades,

- Net position (intraday and end-of-day),

- Settlements of P&L during contract trading and delivery periods,

- Volume fees,

- Intraday and end-of-day margins,

- Collateral deposited with the CCP, monthly deposits/withdrawals and applicable interests,

- Monthly settlement statistics, results on back tests and stress tests.