Accounts structure

OMIClear offers a flexible account structure which encompasses several alternatives in terms of segregation and portability features, in compliance with the provisions set out in EMIR articles 39 and 48.

The details of the account structure as well as of the applicable procedures in case of default are laid down in the following OMIClear’s rules:

- Instruction A05/2014 - Accounts;

- Instruction B18/2014 - Procedures in Case of Default.

which are available to download here.

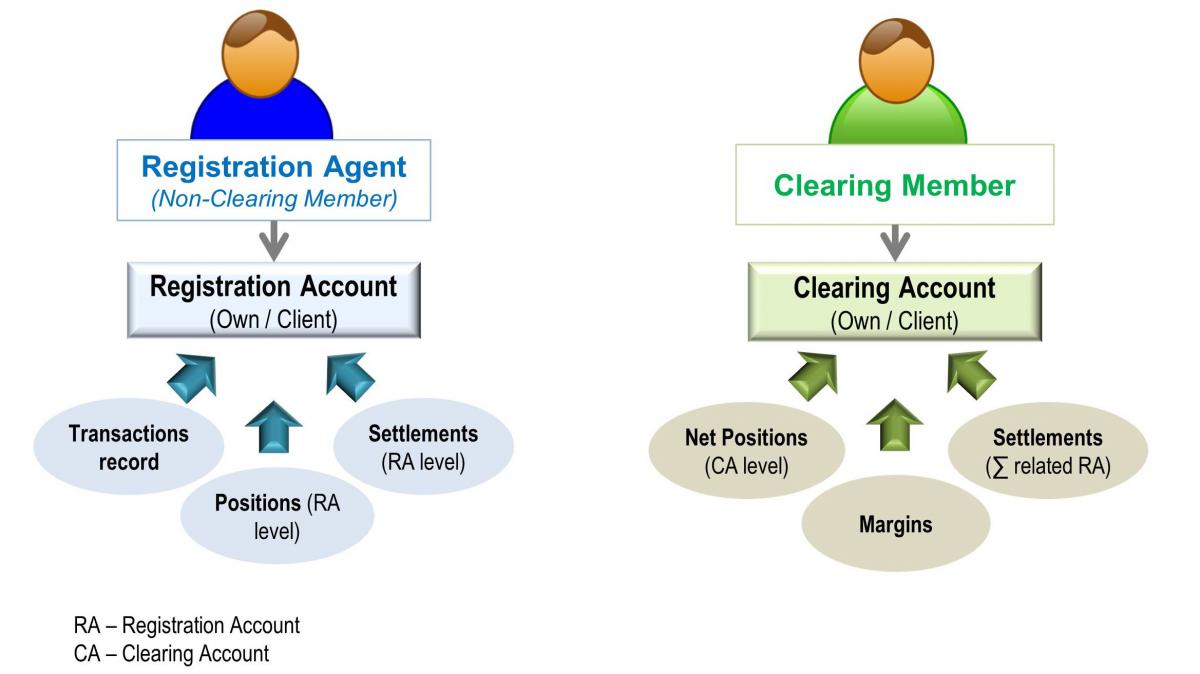

In OMIClear there are two main types of accounts depending on the Participant role with OMIClear:

Accounts Fees

OMIClear charges fees for the opening and maintenance of registration and clearing accounts, which are publicly available in its pricelist.

Accounts Management

- To open, modify or cancel Registration Accounts in OMIClear, the Registration Agent shall fill out form T07/C33 (shared with OMIP Derivatives Market for trades coming from this market) or form C33 (for trades coming from other connected markets) – available to download here.

- To open, modify or cancel Clearing Accounts in OMIClear, Clearing Member shall fill out form C16 – available to download here.

The Registration Accounts are held by the clients of the Clearing Members - Registration Agents (also known as ‘NCM - Non-Clearing Members’), or clients of Registration Agents acting on third party account, in order to record trades in the CCP.

In terms of ownership, can be:

- Own - account owned by the Registration Agent to record proprietary trades. In case it provides services for third party account (broker) proprietary trades must be segregated from clients’ trades;

- Client – account owned by the client of the Registration Agent acting on third party account (broker).

In terms of nature, can be:

- Financial - to register trades in financial derivatives contracts (contracts which have the settlement in the delivery period through a financial delivery);

- Physical - to register trades in physical derivatives contracts (contracts which have the settlement in the delivery period through a physical delivery).

The clearing system of OMIClear (MiClear) displays the following information on a Registration Account level:

- Trades;

- Net positions (sum of buy and sell positions per contract);

- Settlements (profits & losses during contract’s trading and delivery periods and applicable fees).

The Clearing Accounts are held by Clearing Members for the positions bookkeeping and computation of margin and settlement responsibilities.

Regarding its ownership the clearing accounts can be:

a. Own Clearing Account – when the account it owned by the Clearing Member;

b. Client Clearing account – the owner of the account if the Clearing Members’ client (Registration Agent or the Registration Agent’s client) and in terms of positions and collateral segregation the following options are available:

i. Generic Omnibus;

ii. with individual segregation;

iii. with omnibus segregation.

The clearing system of OMIClear (MiClear) displays the following information on a Clearing Account level:

- Net positions (sum of buy and sell positions per contract resulting from the aggregation of the connected registration accounts);

- Margins (margin is always calculated on a clearing account level, based on the net position on the clearing account concerned);

- Settlements (sum of profits & losses during contract’s trading and delivery periods and applicable fees, resulting from the aggregation of the connected registration accounts).

For further details on each type of Client Clearing Account available in OMIClear see explanation below.

Generic Omnibus Clearing Account (CAGO)

- This account is aimed at recording the positions of the Clearing Member’s clients (Registration Agents or Registration Agents’ clients) that do not opt for an individual or omnibus segregated clearing account.

- Positions of different Registration Agents are completely segregated from each other and recorded in separate CAGO. If there are different Registration Agents belonging to the same company group, they are allowed to clear through a single CAGO. The Clearing Member is allowed to have the positions of its clients that are not Registration Agents held and netted on a single clearing account.

- Margins are calculated based on the positions recorded per each CAGO.

- All CAGO are connected to a specific ‘Generic Omnibus Collateral Account’, i.e. there is a single collateral pool to cover the margins arising from the CAGO. This collateral is recorded separately from the collateral posted by the Clearing Member to cover its own positions as well as from the collateral covering individual or omnibus segregated accounts.

- The Daily Operational Limit (DOL) is calculated on the level of the ‘Generic Omnibus Collateral Account’, i.e. through the balance between the collateral pool regarding all the ‘generic omnibus clients’ of the Clearing Member ant the sum of their margins.

- Portability in case of default:

1. In case of default of a Clearing Member, its clients using CAGO are notified and are given three hours to request the portability of their positions to another Clearing Member (which requires the presentation of the clearing agreement with such backup Clearing Member).

2. Regarding the collateral, the portability can only take place if all the positions regarding all CAGO have been transferred within the time frame specified by OMIClear. Otherwise, the collateral will remain available to close the positions placed in the CAGO which have not been transferred. If at the end of the default process there is a surplus of collateral, it shall be distributed among the clients of the defaulting Clearing Member on a pro rata basis with regards to their margin exposure but capped to their margin requirement.

Clearing Account with Individual Segregation (CAIS)

- Only available for individual clients of the Clearing Member (a Registration Agent or a Registration agent’s client) this account type aim to give the highest level of protection regarding positions and collateral in case of default of the Clearing Member.

- Like the CAGO, positions in CAIS are completely segregated from other positions cleared by the Clearing Member and margins are also calculated based on the positions recorded per each CAIS.

- The main difference is that the collateral allocated to the CAIS is completely segregated from collateral covering other clearing accounts managed by the Clearing Member. The client opting for this account will be related to a segregated Daily Operational Limit (DOL) managed by the respective Clearing Member, calculated through the difference between its individual collateral and the amount of its margin requirements. Collateral and margins from other clients never affect this DOL.

- Portability in case of default:

In case of default of the Clearing Member, the positions and collateral are immediately transferred to another backup Clearing Member. In this scenario OMIClear concedes a 3 days period for the client to present the clearing agreement with such backup Clearing Member. If at the end of such period no clearing agreement is delivered, the positions and collateral are transferred back to the defaulting Clearing Member. Nevertheless, such collateral can only be used to cover the losses for liquidating the positions in the individual segregated account.

Clearing Account with Omnibus Segregation (CAOS)

- This type of account is aimed at groups of clients that intend to have their collateral and positions protected from a possible default of the Clearing Member. It ensures the same level of protection as the individual segregated accounts (CAIS) but applicable to the aggregate positions and collateral of the group of clients.

- The set of clients accessing this type of account must be properly identified within OMIClear and must appoint a representative, who is the contact person for communication issues and decisions regarding the portability of assets and positions.

- The positions of these ‘omnibus segregated clients’ are netted on this account for margining effects and are completely segregated from all other positions cleared by the Clearing Member. The collateral to cover this account is also segregated and recorded separately from other collateral posted by the Clearing Member.

- Portability in case of default:

In case of default the portability of positions and collateral takes place under similar conditions as laid above for the CAIS but for the total positions and collateral (partial transfers are not allowed).

Summary of the main features regarding the different types of Client Clearing Accounts: